Get the free idaho form 910

Show details

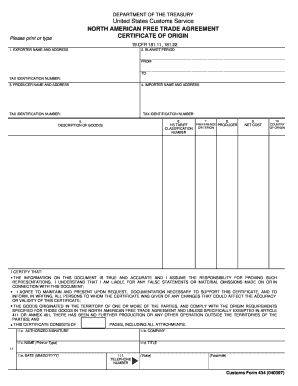

O R M EFO00105 01-02-13 Name of person or organization F 96 IDAHO ANNUAL INFORMATION RETURN Social Security Number or EIN Mailing address City, State and Zip Code INFORMATION FORMS INCLUDED 1. Form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your idaho form 910 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your idaho form 910 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing idaho form 910 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit idaho form 910 fillable. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

How to fill out idaho form 910

Who needs Idaho Form 910?

01

Idaho Form 910 is required for individuals who are claiming a tax credit for excess tax withheld or for a refund of Idaho state taxes paid.

02

This form is specifically for Idaho residents who have had too much tax withheld from their paychecks or who have made excess tax payments throughout the year.

03

Individuals who wish to claim this tax credit or request a refund must fill out Idaho Form 910 accurately and submit it to the Idaho State Tax Commission.

How to fill out Idaho Form 910:

01

Start by providing your personal information in Section A of the form. This includes your name, social security number, and contact details.

02

In Section B, indicate the tax year for which you are claiming the excess tax credit or requesting a refund.

03

Move on to Section C, which requires you to provide details about your income. This includes reporting any wages, salary, tips, interest, or dividends you have received during the tax year.

04

In Section D, you will calculate your excess tax withheld. This involves comparing the total amount of Idaho state taxes withheld from your paychecks with the amount of tax you actually owe.

05

If you have excess tax withheld, fill in Section E to calculate the refundable credit amount. This section helps determine the refundable portion of the excess tax withheld.

06

Complete Section F if you want the refund to be directly deposited into your bank account. Provide the necessary bank details, including the routing number and account number.

07

In Section G, you will need to sign and date the form to certify that the information provided is accurate and complete.

08

Ensure you attach any required supporting documentation, such as W-2 forms or 1099 statements, when submitting Idaho Form 910.

09

Finally, review your completed form to ensure all information is accurate and legible before submitting it to the Idaho State Tax Commission.

Remember, it is essential to consult the instructions provided by the Idaho State Tax Commission for detailed guidance and any specific requirements when filling out Idaho Form 910.

Fill form : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

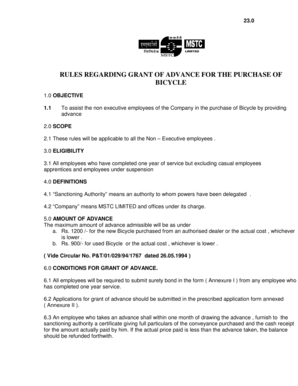

Who is required to file idaho form 910?

Idaho Form 910, also known as the Idaho Annual Withholding Reconciliation, must be filed by employers who are required to withhold and remit Idaho income taxes on behalf of their employees. This form is used to reconcile the total amount of Idaho income tax withheld from employees' wages throughout the year with the amount actually remitted to the Idaho State Tax Commission.

How to fill out idaho form 910?

Unfortunately, without more specific information on the purpose and content of the Idaho Form 910, it is difficult to provide a step-by-step guide on how to fill it out. It's important to refer to the instructions provided with the form itself, as it will outline the required information and provide guidance on how to complete it accurately. You can find the instructions for Idaho tax forms on the official website of the Idaho State Tax Commission. If you have specific questions or need further assistance, it is advisable to consult with a tax professional or contact the Idaho State Tax Commission directly for clarification.

What is the purpose of idaho form 910?

Idaho Form 910, also known as the Estimated Income Tax Worksheet, is used by individuals to calculate and report their estimated income tax liability throughout the year. This form helps taxpayers determine how much they should pay in quarterly estimated tax payments in order to avoid underpayment penalties. The purpose of Form 910 is to assist taxpayers in correctly estimating and paying their income taxes to comply with Idaho tax laws.

What information must be reported on idaho form 910?

Idaho Form 910 is used to report the Annual Withholding Reconciliation for the employer's Idaho income tax withheld. The information that must be reported on Form 910 includes:

1. Employer identification information – This includes the employer's name, address, and federal employer identification number (FEIN).

2. Employee information – The total number of employees during the tax year and their federal and state identification numbers, wages paid to them, and the Idaho tax withheld from their wages.

3. Total wages and withholding – The total wages paid to all employees during the tax year and the total Idaho withholding tax collected from employees.

4. Additional information – Any additional required information or explanations as deemed necessary by the Idaho Department of Revenue.

It is important to consult the instructions for Idaho Form 910 and the Idaho Department of Revenue for specific reporting requirements and any additional information that may be required.

What is the penalty for the late filing of idaho form 910?

Form 910 is used by Idaho residents who have not filed or paid their income taxes by the original due date. The penalty for late filing of Form 910 in Idaho is 5% of the unpaid tax per month, up to a maximum of 25%. Additionally, interest will accrue on the unpaid tax at a rate of 4% per year. It's important to note that penalties and interest may vary, so it's recommended to consult the Idaho State Tax Commission or a tax professional for specific and up-to-date information.

How do I complete idaho form 910 online?

With pdfFiller, you may easily complete and sign idaho form 910 fillable online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out form 910 idaho using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign idaho form 910 pdf and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete idaho 910 on an Android device?

Use the pdfFiller app for Android to finish your form 910. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your idaho form 910 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 910 Idaho is not the form you're looking for?Search for another form here.

Keywords relevant to form 910 idaho withholding payment

Related to idaho 910 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.